Differentiation of a company’s thesis matters most

When we were raising SeamlessMD’s seed round last year, we were asked about our competitors and how we were different.

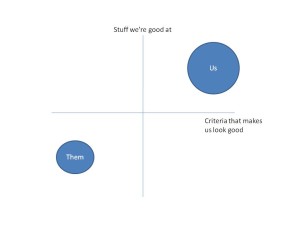

Usually an entrepreneur will show investors how they are ahead of their competitors on important dimensions in today’s market (e.g. cost, performance, etc.). Unfortunately, the desire to appear unique can lead to a misguided view on what’s important for differentiation [1].

Image Source: FlowVentures

This is a problem created by both sides of the table. Investors may suggest that companies must be differentiated today, or they aren’t worth investing in. In response, entrepreneurs look for ways to appear unique – which, in the worst possible outcome, can lead them to focus on the wrong dimensions.

We’ve certainly experienced this, as I’m sure have many other investors and entrepreneurs. However, in retrospect, I believe this is the wrong approach.

As much as today matters, tomorrow is far more important. Investors are investing for a future return. Entrepreneurs are building a company to last.

If that’s true, then what’s more important is for both parties to understand the entrepreneur’s plan to be the last one standing, rather than just looking at where the company stands today.

When it comes to differentiation, both the investor and the entrepreneur should care most about the lens through which the entrepreneur views the path to the future, and how that differs from her competitors.

That is, her core theses for how the market will evolve, and therefore, the guiding principles her company should believe in to drive the company roadmap.

Competitors are unlikely to disagree about truths in the market today. But they are likely to disagree about some truths for the market of tomorrow [2]. And if you’re in a winner take all market, these differences in fundamental beliefs will drive differences in the outcomes of both companies.

It’s this differentiation in company theses that really matters most. Because the 2×2 matrix may tell you what’s different today, but understanding one’s lens gives you a hint for how things will unfold tomorrow.

[1] For example, a company’s competitive landscape is often a table listing differences in features. The entrepreneur will focus on the list of features her company excels in but her competitors don’t. The problem with focusing on features for differentiation is that feature gaps have an easy solution (i.e. just build the missing features). There’s nothing defensible long-term about having more features.

[2] While many companies look similar on the surface, you can learn a lot about a company’s theses from what’s available in the public. The messaging in their marketing materials, the customer segment they focus on, the announcements they make to the world. When you take a deep dive at all the material, you get a fairly good glimpse of how a company thinks about the future.